Getting Started with Fiscal Cloud

Welcome to Fiscal Cloud, your all-in-one platform for virtual fiscalisation solutions. To use the virtual solutions effectively, clients must first create a virtual device. This document will guide you through the process of registering on our platform, logging in, and creating your virtual device.

Prerequisites

- Access to the Fiscal Cloud platform.

- A valid email address for registration.

- A valid VAT Certificate.

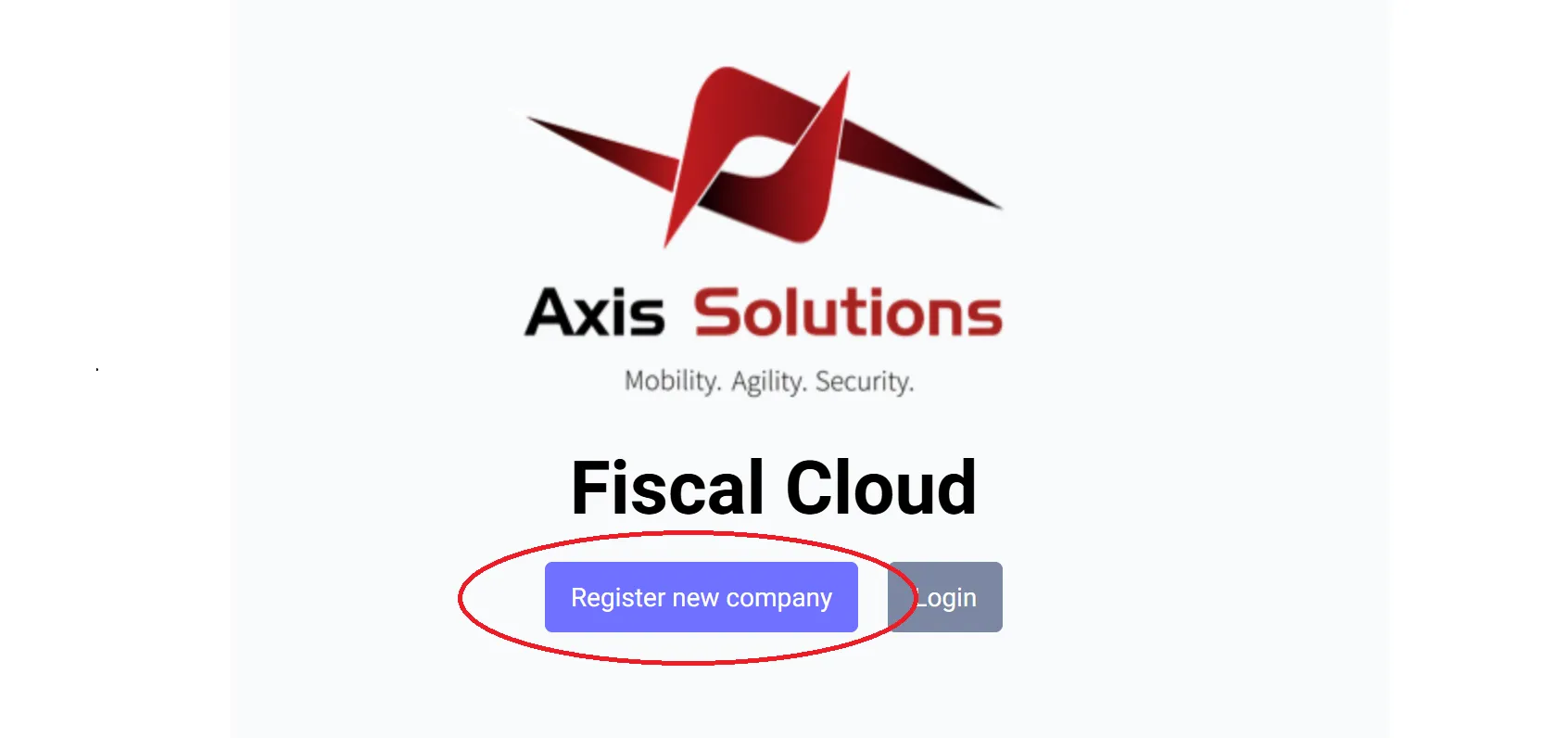

Step 1: Register on the Fiscal Cloud Platform

-

Visit the Registration Page

Click here to access the registration page.

-

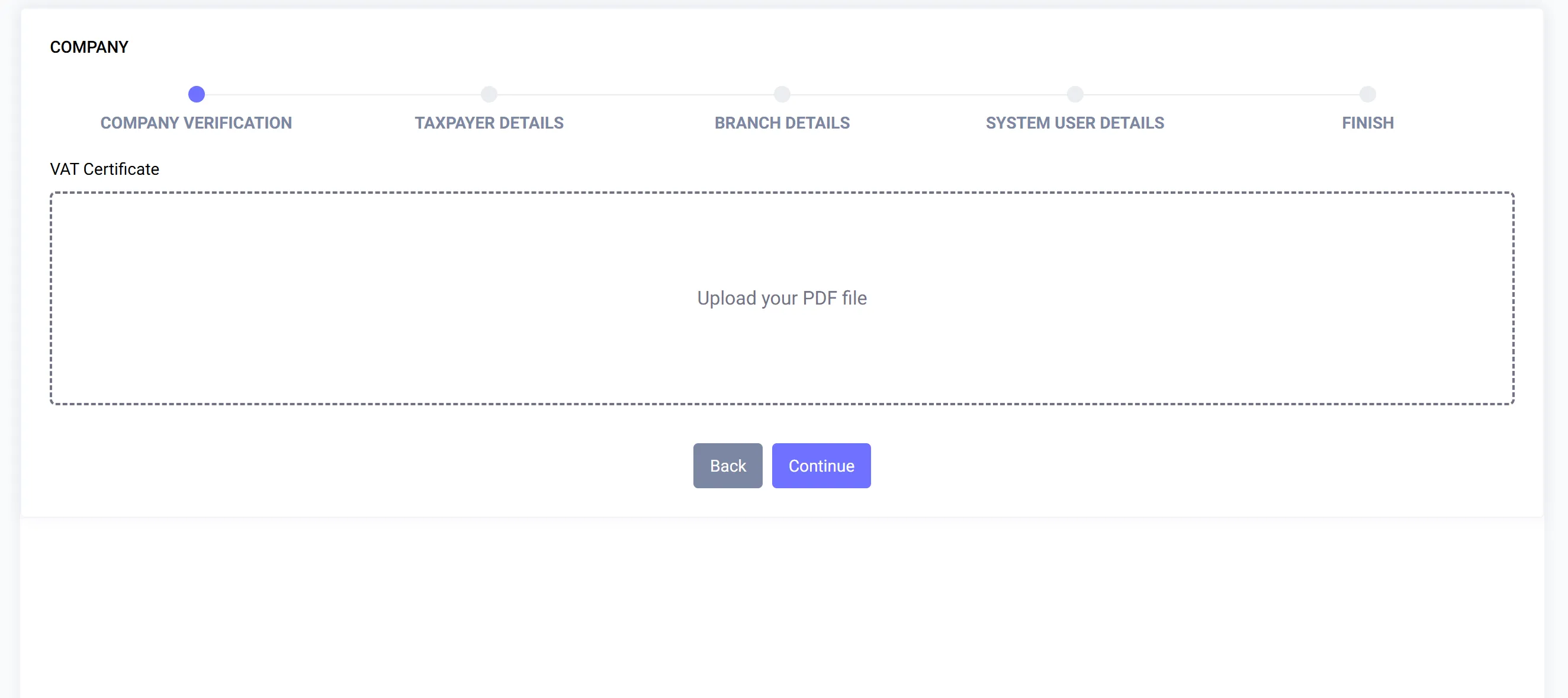

VAT Certificate Upload

- When you begin registration, you will be prompted to upload your VAT Certificate.

- Upload your VAT certificate, ensuring it is not password-protected or encrypted. The certificate will be validated for authenticity.

Example VAT Certificate:

- When you begin registration, you will be prompted to upload your VAT Certificate.

-

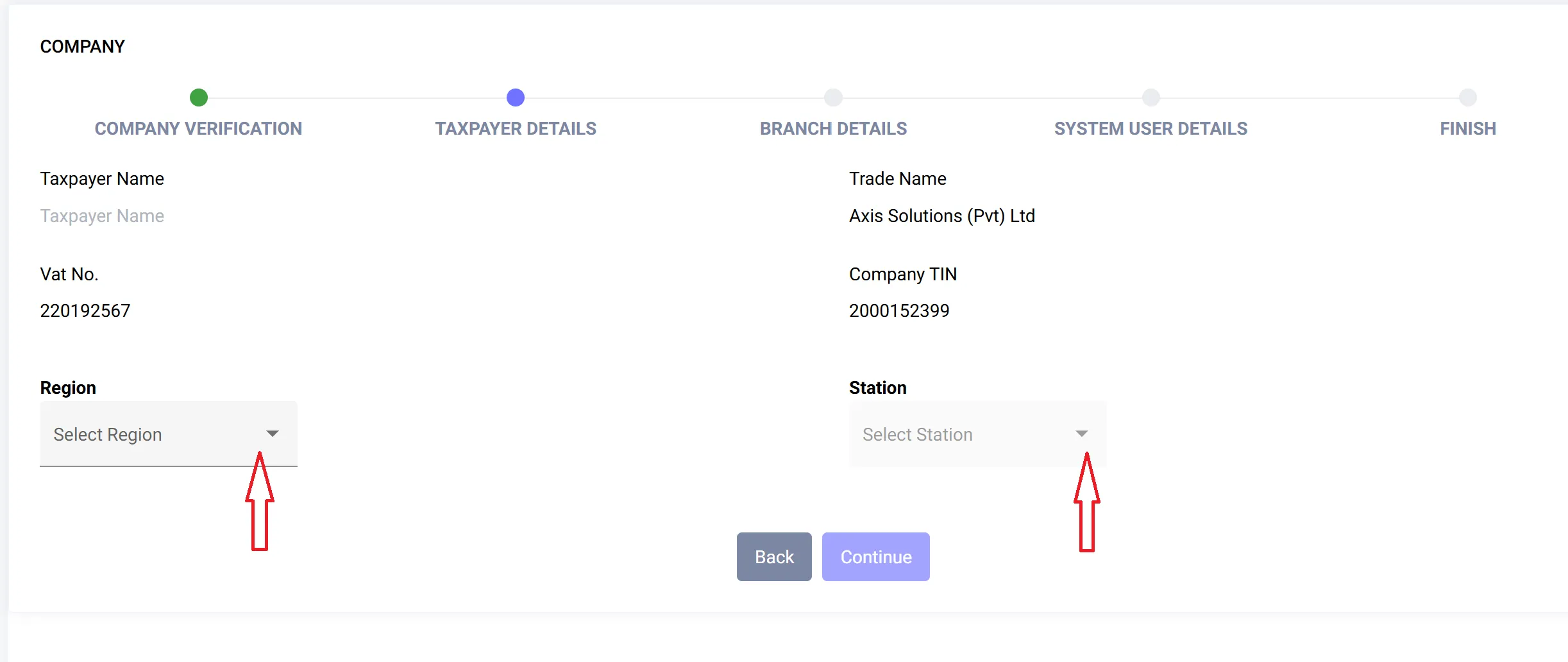

Taxpayer Details

After successful validation of your VAT certificate, you will proceed to enter Taxpayer Details, including:- Region: Specify whether your company falls under Small, Medium, or Large Client Office.

- Station: Select the ZIMRA operational location where your company interacts with ZIMRA services (e.g., Kurima House – LCO).

-

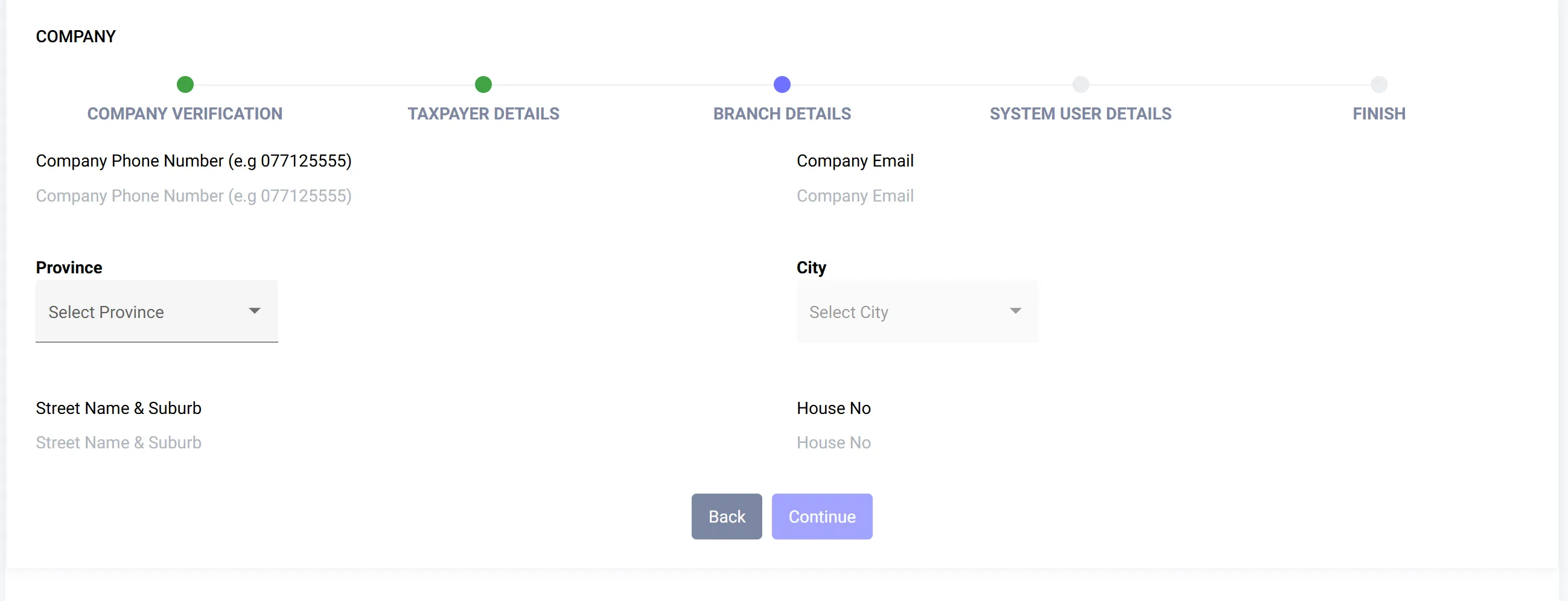

Branch Details

Next, you will be prompted to enter your Branch Details, such as:- Company Phone Number

- Company Email

- Province

- City

- Street Name & Suburb

- House Number

-

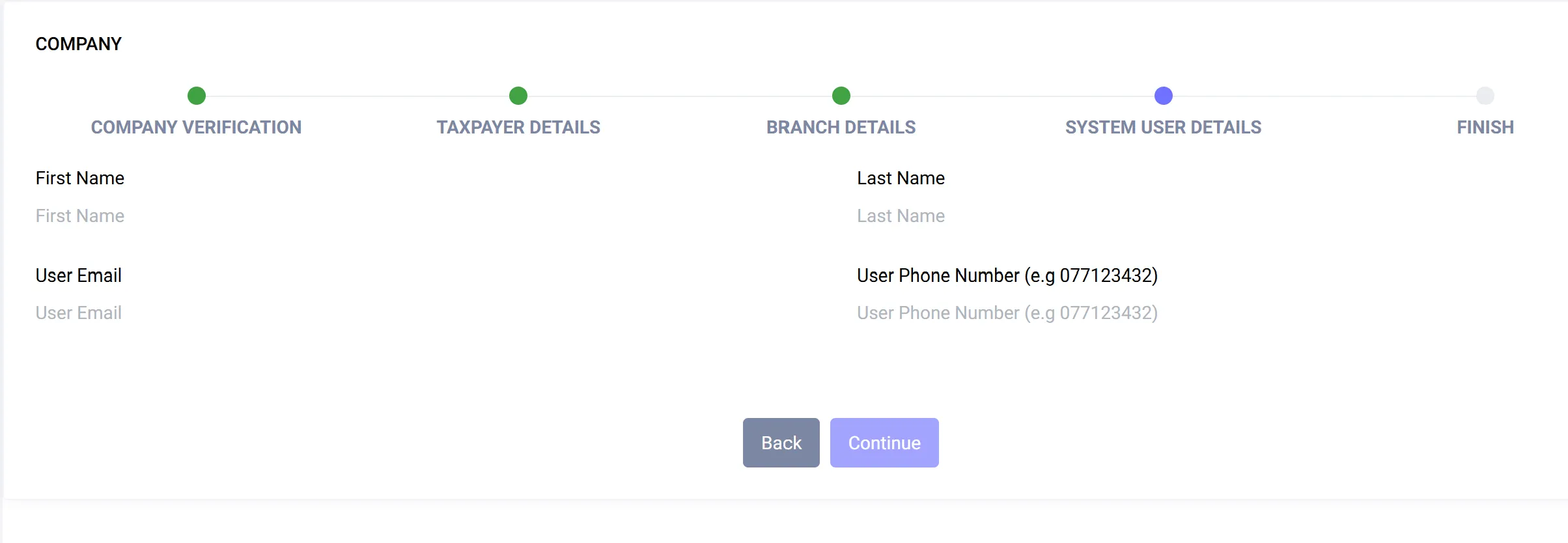

System User

Finally, create a System User for the platform. Fill out the following fields:- First Name

- Last Name

- Email Address

- Phone Number

-

Submit Information

Once all details are entered, verify the information and click Submit.The submitted information will be reviewed and verified by Axis Solutions. Upon approval, your account credentials will be sent to your registered email.

Need Assistance?

If you encounter any issues or need further guidance, contact our support team via:

- Email: callcentre@axissol.com or helpdesk@axissol.com

- Live Chat: Access Alexis, our virtual assistant, directly on the platform.