Virtual RevPOS Lite

Settings Guide

The Settings section in Virtual RevPOS Lite allows you to configure key aspects of your accounting system, including company details, tax rates, fiscalisation modes, currencies, and printing options.

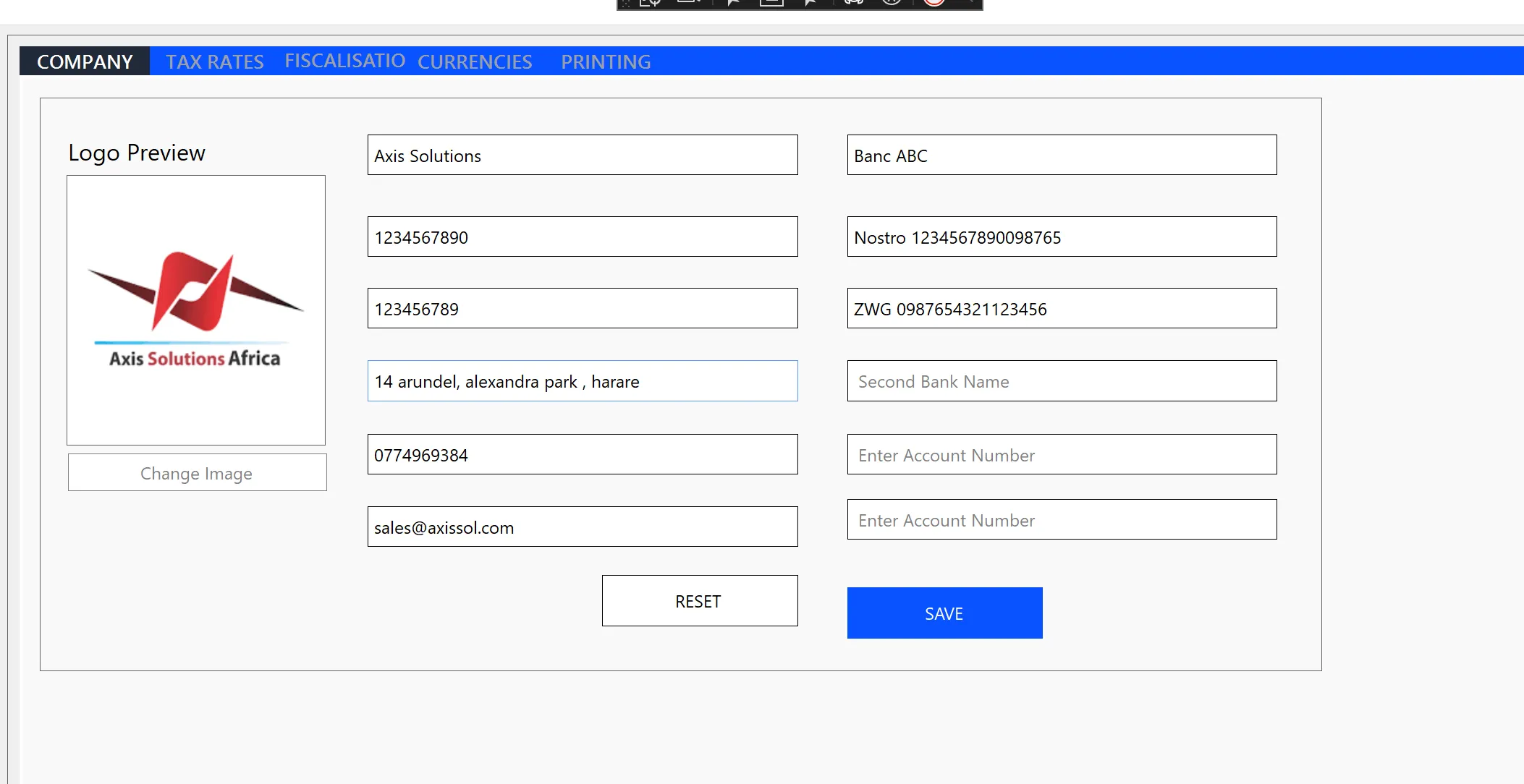

Company Settings

This section enables you to configure your company details, such as:

- Company Name

- TIN (Taxpayer Identification Number)

- VAT Number

- Address

- Banking Details

- And more.

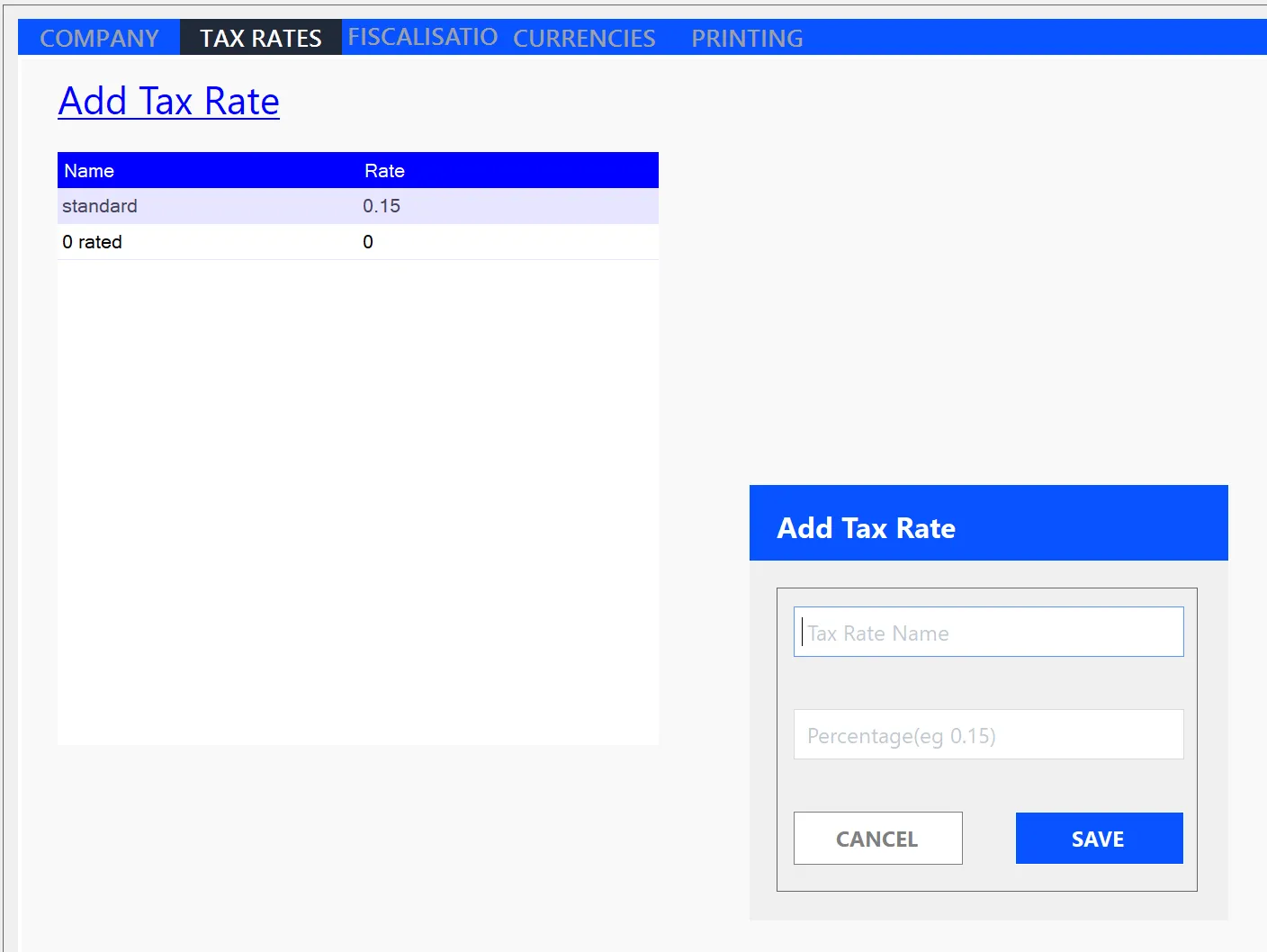

Tax Rates Settings

In this section, you can define the tax rates applicable to your products, such as:

- Standard Tax (15%)

- Non-Vatable (0%)

- Exemptions

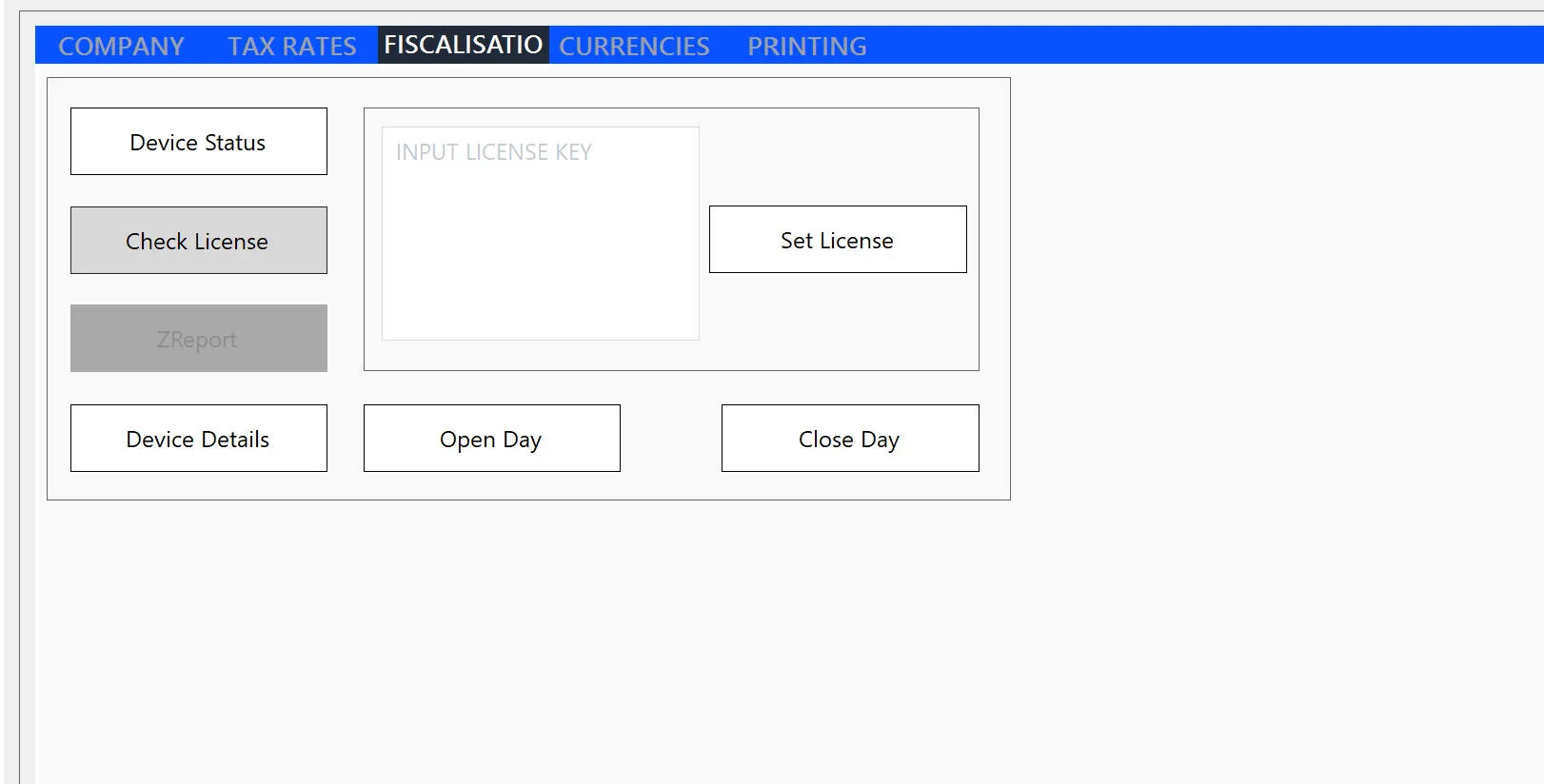

Fiscalisation Settings

This section allows you to manage fiscalisation operations, including:

- Setting the license for the device.

- Checking the device status.

- Opening or closing the fiscal day.

- Other fiscalisation-related configurations.

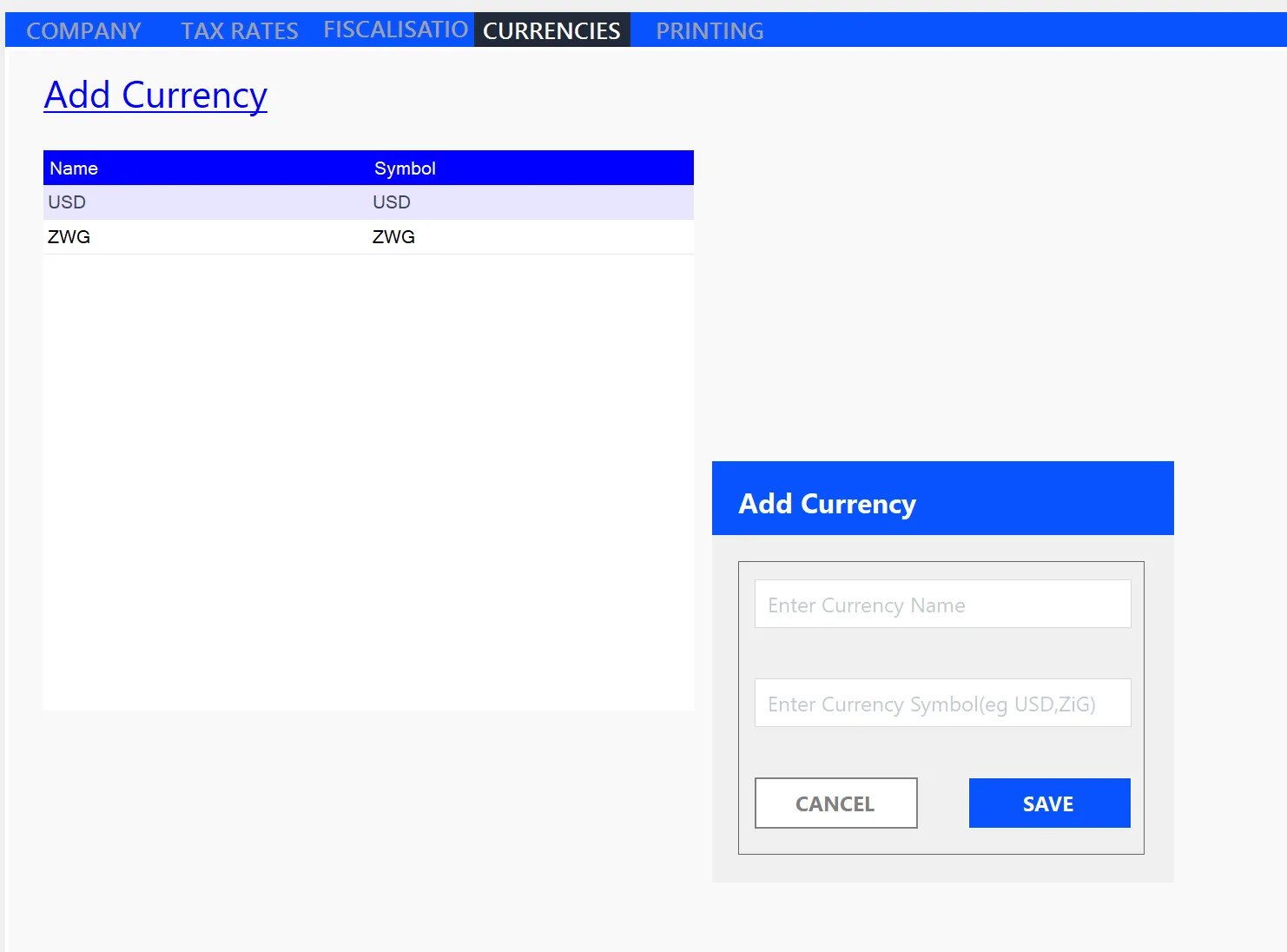

Currencies Settings

Set the currencies in which you invoice, such as:

- ZWG (Zimbabwean Gold)

- USD (United States Dollar)

- ZAR (South African Rand)

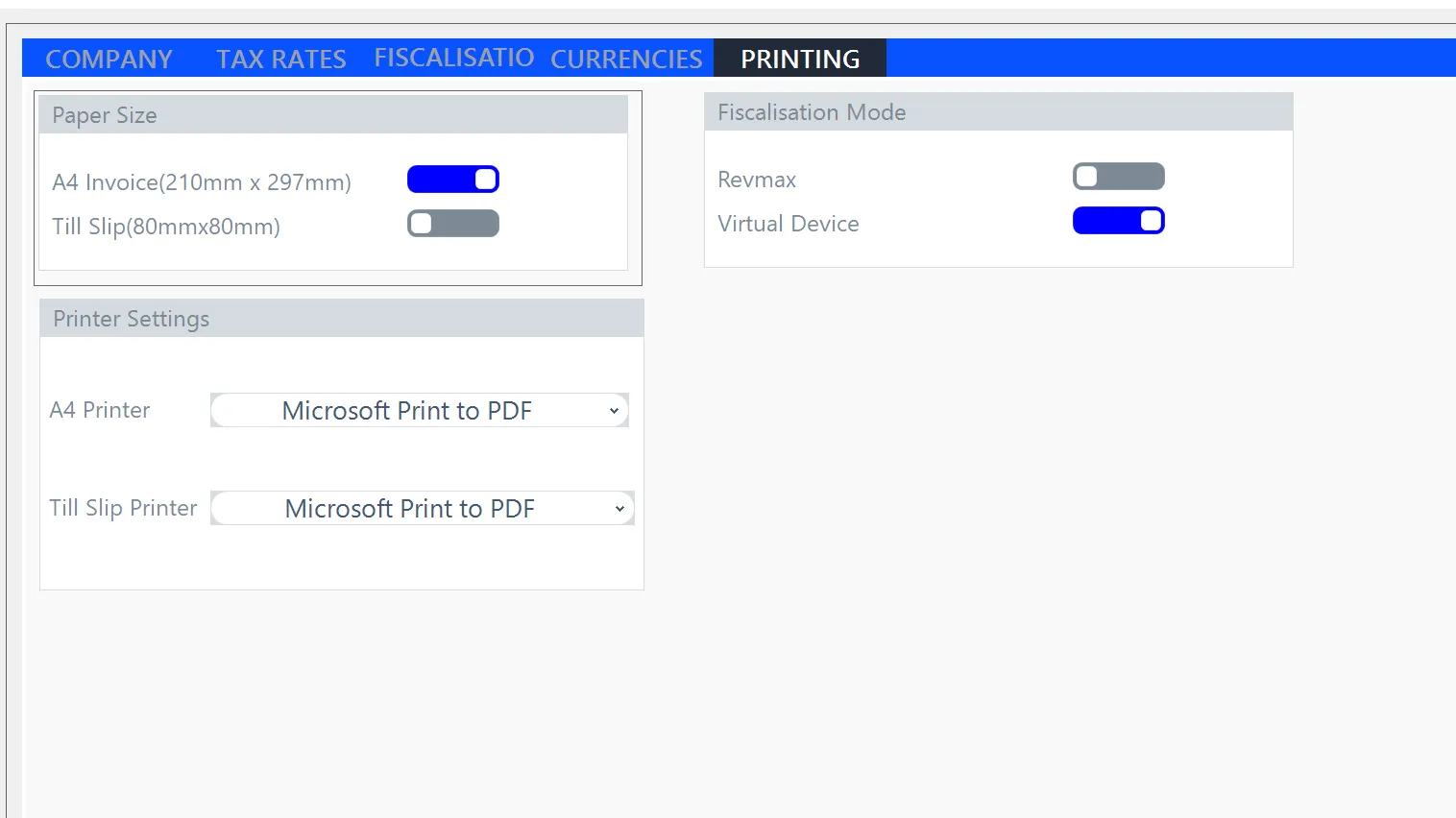

Printing Settings

This section allows you to configure your printing preferences, such as:

- Whether to use the Virtual Printer or not.

- Choosing the output format: PDF or physical printout.

- Selecting a physical printer for hard copy invoices.

For a Demo or assistance, contact our team at helpdesk@axissol.com.